The Price of Incompetence: California's Self-Inflicted Fiscal Catastrophe

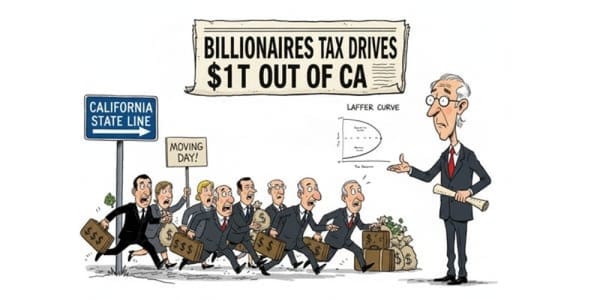

California: $24B on homelessness, 53% increase. $15B on rail, zero miles built. Wealth tax triggered $1T billionaire exodus. Top 1% pay 50% of income taxes—when they leave, you pay. Demand a forensic audit before California gets another dollar.

California just lost $1 trillion in wealth in a single month. Not from an earthquake. Not from wildfires. Not even from a law that actually passed. From a tax proposal that hasn't even made it onto the ballot yet.

Think about that: Sacramento talked about taxing billionaires, and half of them immediately started packing. They didn't wait to see if it would pass. They didn't stick around to fight it. Billionaires worth a collective $500 billion left on January 1st just to avoid the proposal's cutoff date. The proposed 5% wealth tax hasn't even collected a single signature for the ballot, and it's already driven out more wealth than it could ever hope to collect.

This is what happens when a state government proves, over and over, that it can't be trusted with the money it already has.

California Doesn't Have a Revenue Problem. It Has a Spending.

Sacramento has perfected a script. Every year, it's the same performance: We need more money. For the children. For teachers. For healthcare. For housing. For the homeless. The emotional appeals are polished to perfection. The initiatives are wrapped in the language of compassion and necessity. And every year, California voters are told that if they don't approve more bonds, more taxes, more funding measures, the most vulnerable will suffer.

What Sacramento never mentions is where the last round of money went. Or the round before that. Or what happened to the billions already spent on the exact same problems they're now claiming require emergency funding.

California doesn't have a revenue problem. The state collects $10,319 per person in combined state and local taxes—nearly double what Texas ($5,469) and Florida ($4,914) collect. California sits on $1.37 to $1.6 trillion in total debt, including $664 billion in unfunded pension liabilities and $175 billion in unfunded retiree healthcare obligations. The state operates with a $225 billion annual budget.

The money is there. The competence isn't.

Follow the Money: Where Did It Go?

Let's examine California's track record. Not at the margins—not small cost overruns or minor program shortfalls. We're talking about catastrophic, systematic failure across every major initiative Sacramento has touched.

The Homeless Money Pit

California has spent an unprecedented $24 billion on homelessness from 2018 to 2023, with some estimates reaching $37 billion over six years. That's $160,000 spent per homeless person based on 2019 figures. For context, the median home price in many parts of America is less than that.

The result? Homelessness increased 53%—from roughly 151,000 people in 2013 to more than 181,000 in 2023. California spent a quarter of a trillion dollars and got 30,000 more homeless people for its trouble.

But here's the truly damning part: nobody knows where the money went. A state audit found that the California Interagency Council on Homelessness hasn't tracked spending or outcomes since June 2021. When auditors examined five major programs, three programs totaling $9.4 billion couldn't be evaluated because there was so little data available.

For programs that could be assessed: only 13% of placements resulted in permanent housing, while 44% of people returned to homelessness.

Governor Newsom vetoed bipartisan legislation that would have required annual evaluations of homelessness spending. Read that again: Sacramento spent $24-37 billion, has no idea where most of it went, got worse results than doing nothing, and then vetoed accountability measures.

This isn't mismanagement. This is either criminal incompetence or something worse.

The Train to Nowhere

In 2008, California voters approved a $9.95 billion bond for high-speed rail, with a total projected cost of $33 billion. Voters were promised a transformative system connecting San Francisco and Los Angeles in under three hours, operational by 2020.

Seventeen years later: $15+ billion spent, zero miles of high-speed track laid, and a current cost estimate of $106-$135 billion—more than three times the original promise.

The scope has been slashed from an 800-mile system to just 171 miles connecting Merced to Bakersfield—cities that weren't even part of the original vision. Even this drastically reduced segment faces a $7 billion funding gap.

The federal government recently terminated $4 billion in funding, citing mismanagement, missed deadlines, and overrepresented projections. A 2018 state audit titled its report: "Its Flawed Decision Making and Poor Contract Management Have Contributed to Billions in Cost Overruns and Delays."

Voters approved $9.95 billion for a specific project. Sacramento spent $15+ billion building nothing, now claims it needs another $100+ billion to maybe finish a fraction of what was promised, and has the audacity to ask for more.

The Pension Fund Gamble

While Sacramento lectures others about fiscal responsibility, the California Public Employees' Retirement System (CalPERS) gambled with public employee retirement money on politically motivated investments.

In 2007, CalPERS committed $468 million to its Clean Energy & Technology Fund. Nearly two decades later, the fund has lost 71% of its value—a $330 million loss. If that same money had been invested in a basic S&P 500 index fund, it would be worth over $3 billion today.

That's not a typo. California's pension managers turned what should have been $3 billion into $138 million—and still paid investment managers $22 million in fees for losing money.

When journalists requested details, CalPERS refused to release information, citing exemptions for private equity records. The pension system is only 79% funded, leaving taxpayers on the hook for approximately $180 billion in unfunded liability.

The Pattern Is Clear

These aren't isolated incidents. This is systematic failure:

- Homelessness: $24-37 billion spent, 53% increase in homeless population, no tracking of outcomes

- High-speed rail: $15+ billion spent, zero miles built, costs tripled, scope slashed by 80%

- Pension investments: $330 million lost gambling on politics instead of returns

- Total debt: $1.37-1.6 trillion, or approximately $125,000 per household

- Unfunded pension/healthcare obligations: From 2012-2022, unfunded public employee debt increased 710%, from $19 billion to $154 billion

These aren't marginal misses. These are catastrophic failures. And every single time, Sacramento's response is the same: We need more money.

The Billionaire Tax: California's Economic Suicide Note

Now Sacramento—pushed by the Service Employees International Union-United Healthcare Workers West (SEIU-UHW)—wants to solve its self-created fiscal crisis with what they're calling a "billionaire tax." The proposal would hit California residents worth over $1 billion with a one-time 5% tax on their total net worth.

But here's what makes this policy catastrophically bad: It's not what they're calling it.

As White House AI and Crypto Czar David Sacks explained: "To be clear, the Billionaire Tax Act in California is not (just) an unrealized gains tax. It's a 5% across-the-board confiscation of net worth. It applies even if one has already realized and paid taxes on the entire amount."

Read that again. This isn't just taxing unrealized gains. It's taxing money people already paid taxes on. It's double taxation. You sell stock, pay capital gains tax, then California comes back and demands 5% of what's left. That's not a tax—it's confiscation.

The policy hits everything: stocks, real estate, private company shares, startup equity, art, cryptocurrency, luxury goods—5% of all of it. And it's retroactive to January 1, 2026. If you were a California resident on that date, you owe the tax—even if the measure doesn't pass until November and you've already left the state.

If you can't pay the lump sum (and most can't, because most billionaire wealth is illiquid), you can spread payments over five years—but California charges you a 7.5% annual deferral fee on the remaining balance. That's not an interest rate. That's a penalty for not having liquid cash equal to 5% of your total net worth.

Here's the nightmare scenario for startup founders, explained by Palmer Luckey, co-founder of defense tech company Anduril: A founder builds a company. The company gets valued at $2 billion in a private funding round. The founder owns 51%, making their net worth $1.02 billion on paper. They now owe California $51 million in wealth tax.

But here's the problem: that stock is illiquid. It doesn't trade publicly. The founder can't sell it without giving up control of their company. And even if they could sell, there might not be buyers. So the founder has three options:

- Sell "huge chunks of our companies" to meet the tax obligation—which means losing control and potentially destroying the business

- Take out massive personal loans using the stock as collateral—which creates a death spiral if valuations drop

- Leave California entirely—which is exactly what's happening

As Luckey warned: "One market correction, nationalization event, or prohibition of divestiture and I am screwed for life."

The tax doesn't account for valuation drops. If a founder's company is worth $2 billion in January, they owe $51 million. If the company's valuation crashes to $500 million by the time they have to pay—tough luck. They still owe $51 million on wealth that no longer exists.

California's own Department of Finance warned in a joint review that the tax would likely deliver tens of billions in one-time funds but "could lead to hundreds of millions or more in annual losses from billionaires leaving."

Even Governor Newsom is now "working relentlessly behind the scenes" to kill it. He told the New York Times: "This is what I feared, and it's come true."

Even Reid Hoffman, Democratic mega-donor and LinkedIn co-founder, called the proposal a "horrendous idea" that's "badly designed in so many ways" and would force tech founders to flee.

Before the measure even collected signatures for the ballot, the results are in: $1 trillion in wealth has already fled the state.

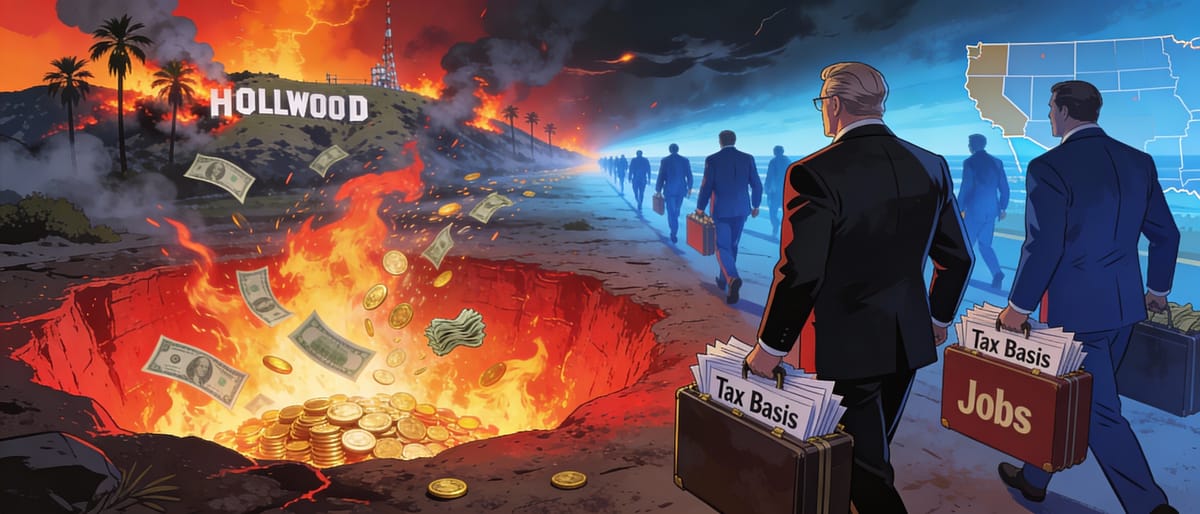

(Meanwhile, fire victims whose homes burned in January 2025 still owe property taxes on empty lots they're prohibited from rebuilding due to Sacramento's regulatory delays—only 12-16% have even received building permits a year later. But Sacramento has its priorities.)

Venture capitalist Chamath Palihapitiya has been tracking the exodus: "We had $2 trillion of billionaire wealth just a few weeks ago. Now, 50% of that wealth has left—taking their income tax revenue, sales tax revenue, real estate tax revenue and all their staffs (and their salaries and income taxes) with them."

On January 1, 2026—the proposed tax's cutoff date—several billionaires worth a collective $500 billion "scrambled and left California for good," according to Palihapitiya. The tax hasn't passed. It hasn't made the ballot. The mere threat was enough.

Palihapitiya's warning should terrify every middle-class Californian: "California billionaires were reliable taxpayers. They were the sheep you could shear forever. Now California will lose this revenue source forever. Unless this ballot initiative is pulled, we will not stop the billionaire exodus. With no rich people left in California, the middle class will have to foot the bill."

He predicts the proposal has "single-handedly changed the trajectory of the California economy by $100 to $200 billion over the next five to 10 years."

Who Pays When the Rich Leave?

Here's the math California politicians don't want you to understand.

The top 1% of earners pay between 39-50% of California's income tax revenue. When they leave, that revenue disappears. The state still needs to fund services—or at least pretend to, given the track record. The bills don't vanish just because the billionaires do.

Someone has to pay. Guess who?

California collects $10,319 per person in combined taxes—nearly double Texas ($5,469) and Florida ($4,914). The difference isn't property taxes or sales taxes, which are comparable. The difference is income tax: California extracts $3,735 per capita while Texas and Florida collect zero.

This model only works when high earners stay. California saw net emigration of more than 200,000 people in 2024-2025. Previous tax hikes wiped out nearly half of the expected revenue within a year as high earners relocated or adjusted their taxable income.

Major corporations have already left: Chevron, Tesla, SpaceX, Oracle, Hewlett Packard Enterprise, and Charles Schwab all moved headquarters to Texas. They took jobs, investment, and tax revenue with them.

When billionaires leave, the cascading effects hit everyone:

- Their household staff relocates—taking payroll taxes

- Their real estate sits vacant or sells—eliminating property tax revenue

- Their local spending disappears—reducing sales tax collections

- Their startup investments dry up—killing future tax revenue

- Their charitable giving evaporates—shifting burden to government programs

Remove half the state's billionaire wealth, and you remove billions in annual tax revenue that Sacramento has already spent—multiple times over, if the debt load is any indication.

Middle-class Californians already pay some of the highest taxes in America. When the top 1% stops shouldering 40-50% of the income tax burden, that load shifts down. Property taxes rise. Sales taxes increase. Fees multiply. Gas taxes jump. The cost of living—already crushingly high—becomes unbearable for working families.

This is Sacramento's plan: Light money on fire with no accountability, drive out the people paying the bills, then demand middle-class families make up the difference. All while hiding behind emotional appeals about children and teachers and healthcare.

The Ro Khanna Delusion

Representative Ro Khanna, who represents Silicon Valley, dismissed concerns about the exodus. "Peter Thiel is leaving California if we pass a 1% tax on billionaires for 5 years to pay for healthcare for the working class," Khanna wrote, echoing FDR: "I will miss them very much."

Khanna misses the point entirely—perhaps deliberately.

The people leaving aren't hypothetical founders deciding whether to start companies. They're established billionaires who can work from anywhere on the planet. Jensen Huang of Nvidia might stay—he's said he's "perfectly fine" with whatever taxes California wants to levy. But Larry Page and Peter Thiel aren't waiting around to find out. They've already adjusted their residencies to avoid the January 1 cutoff.

It doesn't matter whether California could theoretically support innovation without these individuals. What matters is that California's budget—the budget that funds schools, roads, healthcare, and public safety—depends on their tax payments. Remove half the billionaire wealth, and you remove billions in annual tax revenue that the state has already spent.

David Friedberg, co-founder of Ohalo Genetics, explained the dynamic: "As soon as you tell people, 'Hey, we're doing property seizures,' or the threat of property seizures... everyone is like, 'See ya.'"

Khanna can quote FDR all he wants. FDR didn't have to compete with zero-income-tax states connected by five-hour flights and Zoom calls. The wealthy in the 1930s couldn't simply relocate their tax domicile while maintaining their business operations. In 2026, they can—and they are.

Sacramento crossed a line. They signaled that private wealth is public property to be seized when politicians need money. Once you cross that line, trust evaporates. And without trust, California's entire revenue model collapses.

Pass An Audit Before Voters Give Another Dime

California voters should not approve another bond, tax increase, or funding measure of any kind until Sacramento answers for the money it already has.

Not suggestions. Not reforms. Hard requirements:

1. Independent Forensic Audit

California must conduct a comprehensive, independent forensic audit of every major spending initiative from the past decade. Not an audit by the agencies reviewing themselves. A genuine third-party examination with subpoena power, criminal referral authority, and public reporting requirements.

Every program that received taxpayer dollars must account for:

- How much was spent

- Where the money went (actual expenditures, not categories)

- What outcomes were promised

- What outcomes were delivered

- Who approved the spending

- Who benefited from the spending

The audit must have authority to pursue criminal charges if evidence of fraud, embezzlement, or money laundering is discovered. Because at this scale, with this level of failure, "incompetence" stops being a credible explanation.

2. Public Accountability Hearings

Every official involved in these failures must testify under oath in public hearings:

- Who approved the CalPERS green energy fund that lost 71%?

- Who decided to stop tracking homeless spending outcomes in 2021?

- Who authorized starting high-speed rail construction before acquiring land?

- Who signed off on contracts with firms known for cost overruns?

- Who benefits from the lack of oversight?

These aren't natural disasters. These are decisions made by specific people who should answer for them.

3. Structural Reforms Before New Revenue

Before any new funding measure reaches the ballot:

- Implement mandatory sunset provisions for all programs (no program runs indefinitely without reauthorization)

- Require annual outcome reporting with penalties for non-compliance

- Create independent oversight for pension investments with fiduciary duty standards

- Establish clawback provisions for contractors and officials involved in failed projects

- Institute real-time public tracking of spending (no more "we lost track of $9.4 billion")

- Ban emergency declarations to bypass accountability measures

4. Consequences for Mismanagement

Officials who oversaw these failures should face consequences:

- Termination for officials who lost track of billions

- Pension reductions for executives who presided over 300%+ cost overruns

- Criminal referrals for potential fraud or embezzlement

- Lifetime bans from public service for officials who approved spending without oversight mechanisms

The private sector fires executives who lose money. Government officials who lose billions get promoted and ask for more money.

5. End the Fiscal Gaslighting

No more:

- Creative accounting that turns deficits into surpluses by raiding reserves

- Claiming balanced budgets while sitting on $1.6 trillion in debt

- Promising transformation while delivering failure

- Hiding behind children and teachers while funding fails to reach classrooms

- Emergency declarations to bypass voter approval

- Off-budget spending that hides true costs

California must present honest budgets with honest accounting. If the state can't balance its books, it should say so—and explain why voters should trust it with more money.

The Choice

This is the moment California voters decide whether they're citizens or ATMs.

For decades, Sacramento has operated on a simple model: spend money poorly, demand more money, repeat. Hide the failures behind emotional appeals. Blame "revenue problems" instead of spending problems. Drive out the people paying the bills, then demand everyone else make up the difference.

The billionaire tax proposal exposed the scam. Sacramento's response to decades of fiscal incompetence is to threaten the seizure of private wealth. The predictable result: $1 trillion in wealth fled before the measure even reached the ballot.

Now comes the test: Will California voters reward this behavior by approving more funding? Or will they demand accountability first?

The answer should be simple: Not one more dollar until Sacramento explains what happened to the last trillion.

Vote no on every bond measure. Vote no on every tax increase. Vote no on every funding initiative—no matter how compelling the emotional appeal, no matter how dire the warnings about consequences.

Sacramento created this crisis through incompetence, mismanagement, and potentially worse. Sacramento's solution is to demand more money from the people they've already betrayed.

When Sacramento conducts a genuine forensic audit, holds public accountability hearings, implements real structural reforms, and demonstrates it can manage money responsibly, then—and only then—should voters consider new funding.

Until that day comes, every funding request deserves the same answer the billionaires gave the wealth tax: We're done.

California doesn't have a revenue problem. It has a competence problem, an accountability problem, and a leadership problem. More money won't fix any of those. It will just mean more money disappears into the same black hole that swallowed $24 billion in homeless spending, $15 billion in rail construction, and $330 million in pension gambling.

The bill is coming due. And unless voters demand accountability now, the middle class will be the ones paying it.

The power to say no belongs to voters. Use it.

SOURCES

- NY Post: California loses $1 trillion in wealth - https://nypost.com/2026/01/12/us-news/calif-loses-mind-boggling-1-trillion-in-wealth-in-past-month-alone-over-fears-of-billionaire-tax-wealth-guru/

- Fox Business: California wealth tax hemorrhages $1 trillion - https://www.foxbusiness.com/politics/california-billionaire-tax-proposal-hemorrhages-1-trillion-billionaires-flee

- Yahoo Finance: Chamath on $500 billion exodus - https://finance.yahoo.com/news/chamath-palihapitiya-says-people-worth-223010069.html

- CalMatters: California homeless audit - https://calmatters.org/housing/homelessness/2024/04/california-homelessness-spending/

- Folsom Times: $37 billion homeless funding report - https://folsomtimes.com/report-37-billion-in-homeless-funding-is-lacking-in-results/

- Hoover Institution: Despite $24 billion spent, homelessness increased - https://www.hoover.org/research/despite-california-spending-24-billion-it-2019-homelessness-increased-what-happened

- CBS San Francisco: Audit on homeless spending - https://www.cbsnews.com/sanfrancisco/news/california-homelessness-spending-audit-24b-five-years-didnt-consistently-track-outcomes/

- Senator Dave Cortese: KQED homeless report - https://sd15.senate.ca.gov/news/kqed-californias-20-billion-effort-combat-homelessness-fails-curb-rising-unhoused-population

- Fox Business: High-speed rail timeline - https://www.foxbusiness.com/economy/timeline-californias-years-long-disastrously-overpriced-high-speed-rail-project

- US DOT: High-speed rail review announcement - https://www.transportation.gov/briefing-room/us-transportation-secretary-duffy-announces-review-california-high-speed-rail-project

- US DOT: Federal funding termination - https://www.transportation.gov/briefing-room/trumps-transportation-secretary-sean-p-duffy-pulls-plug-4b-california-high-speed

- Hoover Institution: High-speed rail should have been stopped - https://www.hoover.org/research/verge-losing-4-billion-federal-funds-high-speed-rail-should-have-been-stopped-long-ago

- The Center Square: CalPERS clean energy losses - https://www.thecentersquare.com/california/article_55faf935-81b3-457e-9cb3-006fd895dbdf.html

- Valley Roadrunner: CalPERS scandal - https://www.valleycenter.com/articles/californias-calpers-scandal-is-a-3-billion-betrayal-of-public-trust/

- California Policy Center: State debt study - https://californiapolicycenter.org/reports/california-public-sector-revenue-and-debt-study/

- Reason Foundation: State debt rankings - https://reason.org/transparency-project/gov-finance-2025/state/

- Hoover Institution: California's $1.6 trillion debt - https://www.hoover.org/research/newsom-wants-add-64-billion-californias-16-trillion-debt-proposition-1

- San Diego Union-Tribune: State and local debt analysis - https://www.sandiegouniontribune.com/2024/11/03/state-and-local-debt-in-california-is-over-half-a-trillion-dollars/

- Legislative Analyst's Office: Proposition 2 debt proposals - https://lao.ca.gov/Publications/Report/4887

- CPA Practice Advisor: Billionaire exodus analysis - https://www.cpapracticeadvisor.com/2025/12/30/will-billionaires-really-leave-california-why-wealth-tax-backers-arent-worried/175621/

- WEHOonline: 2025 California exodus - https://wehoonline.com/2025-exodus-out-of-california-continues/

- Fox News: Washington Post wealth tax warning - https://www.foxnews.com/media/california-regret-billionaire-exodus-washington-post-editorial-warns

- Heritage Foundation: Tax migration study - https://www.heritage.org/taxes/report/if-you-tax-them-they-will-run-millions-americans-flee-california-and-new-york

- Deseret: California billionaire tax exodus - https://www.deseret.com/politics/2025/12/23/california-billionaires-look-at-leaving-tax/

- Newsweek: California wealth tax reactions - https://www.newsweek.com/california-wealth-tax-billionaires-have-said-leaving-state-11350216

- CNBC: Ro Khanna faces Silicon Valley backlash - https://www.cnbc.com/2025/12/29/silicon-valley-ro-khanna-faces-tech-backlash-over-wealth-tax.html

- Robb Report: Billionaires fleeing California - https://robbreport.com/lifestyle/news/billionaires-fleeing-california-wealth-tax-1237498061/

- X/Twitter: Tax comparison infographic - https://x.com/Austen/status/2011061526518776325

- Zero Hedge: Newsom scrambles to keep billionaires - https://www.zerohedge.com/political/newsom-scrambles-keep-billionaires-california-vows-kill-wealth-tax

- California Globe: David Sacks on wealth tax as confiscation - https://californiaglobe.com/fl/bye-bye-billionaires-gavin-newsoms-california-exodus/

- Crypto News: Billionaire tax on unrealized gains - https://crypto.news/californias-billionaire-tax-proposal-draws-backlash-from-crypto-proponents/

- SF Standard: California billionaire tax explained - https://sfstandard.com/2025/12/30/california-s-billionaire-tax-explained/

- Medium: California wealth tax will kill innovation - https://medium.com/@gaetanlion/the-california-wealth-tax-act-to-kill-innovation-32a398fc2dee

- Fortune: Tech founders on proposed wealth tax - https://fortune.com/2025/12/28/california-tech-founders-billionaire-state-wealth-tax-ballot-measure/

- CNN: LA fire rebuilding challenges one year later - https://www.cnn.com/2026/01/08/us/altadena-la-fires-rebuilding-invs

- KQED: Permits still difficult for fire victims - https://www.kqed.org/news/12069371/permits-still-tough-to-come-by-for-fire-victims-looking-to-rebuild-in-la-county