Property Rights Under Siege: The Debate Over Tax, Downsizing, and Generational Wealth

Property taxes challenge true homeownership, sparking debate over fairness, generational wealth, and individual rights. Florida’s proposed reforms highlight tensions between older homeowners and policies intended to help new buyers.

A provocative debate emerged recently on social media regarding Florida's property tax elimination proposals. When one user questioned whether first-time homebuyers would be excluded from property tax relief, the conversation quickly pivoted to a more fundamental question: Should older homeowners be pressured to downsize to "free up homes for younger generations"? One commenter quipped, "You mean like boomers have been doing for 40 years?" referring to the longstanding pattern of older Americans staying in their homes [1].

This exchange captures a growing sentiment that property taxes should function as a tool of social engineering—incentivizing or forcing older homeowners to sell their properties to benefit younger buyers. Proponents frame this as pragmatic housing policy. In reality, it represents a fundamental assault on property rights that would harm all generations, particularly those it purports to help.

The core issues are straightforward but profound:

- You cannot truly "own" something subject to perpetually increasing taxation that can result in government seizure.

- No democratic society can justify forced sale of private property to satisfy another group's preferences.

- This represents redistribution by age class—a difference in degree, not kind, from other forms of compulsory wealth transfer.

Most critically, empirical evidence demonstrates that strong property rights and free markets generate prosperity for all generations, while coercive policies create perverse incentives that reduce overall economic growth and social cohesion.

The Ownership Paradox: When Property Rights Become Perpetual Rental

Property taxes create a fundamental contradiction at the heart of American homeownership. You save for decades, make mortgage payments, finally pay off the loan—and yet you never achieve true ownership. Miss a single year's property tax payment, and the government can seize your home regardless of decades of prior payments and full mortgage satisfaction.

This transforms ownership from an absolute right into a form of perpetual rental from the state. As one policy analyst observed, "You pay off your mortgage to achieve housing security, yet perpetually escalating taxes mean you never achieve true ownership. One missed payment can result in property seizure regardless of decades of prior payments. This is legalized coercion, not sound public finance."

Recent data illustrates this burden's acceleration. Property tax delinquency rates jumped to 5.1% in 2024 from 4.5% the previous year, indicating emerging financial strain across American households. Rising home values increase tax burdens even for those with paid-off mortgages—homeowners in Colorado and Georgia saw tax bills surge by over 50% recently. In Vermont and Illinois, property taxes now consume 11.2% of median household income.

This creates the paradox: you eliminate your mortgage to achieve housing security, but taxation ensures you never escape housing insecurity. The threat of seizure for non-payment transforms what should be secure ownership into conditional possession.

The Forced Transfer Fallacy: Age-Based Wealth Redistribution

Arguments that older homeowners should be "socially forced" to downsize to benefit younger generations represent redistribution by age class. This differs in degree, not kind, from other forms of compulsory wealth transfer that Americans traditionally reject.

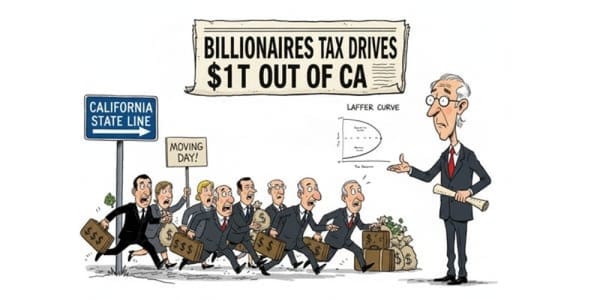

Some economists and policymakers explicitly advocate for this outcome. Minneapolis Federal Reserve modeling demonstrates that higher property taxes technically achieve the intended effect—shifting homeownership toward younger families and motivating downsizing among older homeowners. However, the model's own admissions reveal the moral bankruptcy of this approach.

The researchers acknowledge their policy creates losers: "households are better off over their full lifetime" but only by "sacrificing well-being many years later for well-being in the present day." Translation: we forcibly extract wealth from older adults who planned their retirement around housing security to subsidize younger buyers. This violates the fundamental social contract that private property rights are secure.

Moreover, the capitalization argument—that higher property taxes reduce purchase prices—merely shifts costs rather than reducing them. Buyers pay less upfront but more over time through perpetual taxation. The total housing cost remains identical or increases due to government inefficiency in resource allocation.

No democratic society can justify forced sale of private property to satisfy the preferences of another demographic group. Individual rights cannot be subordinated to collective utility calculations, especially when those calculations disadvantage politically vulnerable groups like the elderly on fixed incomes. This reasoning differs in type, not kind, from historical justifications for wealth confiscation from disfavored groups.

Property Rights as the Engine of Economic Growth

Empirical evidence consistently demonstrates that secure property rights drive prosperity for entire societies, not just property owners. Research across 101 countries from 1990-2002 confirms that high security of property rights is positively associated with higher real economic growth rates, with less developed economies benefiting even more from property rights enhancements than developed nations.

The mechanism is straightforward: a doubling in the index of property rights quality leads to more than doubling in per capita income. Strong property rights create four critical economic benefits that cascade across generations:

- Investment and Innovation: Secure ownership encourages investment in technology and business, accelerating growth benefiting all age groups.

- Efficient Resource Allocation: Property rights ensure resources flow to those who utilize them most effectively.

- Institutional Quality: Legal frameworks protecting property rights correlate with better governance.

- Political Stability: Secure property rights reinforce political and economic stability for all generations.

Without private property rights—including the freedom to keep what one earns and choose what to do with it—economies lack the foundation for prosperity. The connection between property rights and human flourishing is well-documented.

Homeownership as Intergenerational Wealth Transfer

Homeownership represents the primary mechanism for wealth transfer across generations in the United States. Eighty percent of all generational wealth is transferred through property inheritance. This isn't wealth hoarding—it's the foundation of economic mobility for younger generations.

Research documents that one-quarter of intergenerational wealth persistence derives from housing outcomes, with half due purely to parental wealth enabling earlier entry and larger home purchases. When parents can support offspring's housing market entry, the consequences for later-in-life wealth accumulation are substantial.

The housing channel works through three distinct mechanisms:

- Earlier Market Entry: Households with wealthier parents are 50% more likely to enter the housing market in any given period.

- Higher Purchase Values: These households purchase homes worth $75,000 (33%) more upon entry.

- Extended Holding Periods: Wealthier households are 33% more likely to be homeowners at age 30, enabling longer periods of equity appreciation.

Critically, reducing access to homeownership widens the racial wealth gap. Research from Brookings identifies higher homeownership rates among African American and Hispanic families as essential for achieving wealth parity with white households. Policies that undermine property security or force sales harm exactly the populations progressives claim to help.

When we force older homeowners to sell through punitive taxation, we don't just harm them—we sever the primary mechanism through which younger generations accumulate wealth. The parent who cannot hold their property cannot transfer equity to children for down payments. The grandparent forced to downsize cannot bequeath the family home that would anchor the next generation's financial security.

Florida's Property Tax Debate: A Case Study in Policy Trade-offs

The current debate in Florida illustrates these tensions. Multiple proposals aim to eliminate or dramatically reduce property taxes on primary residences, with several competing approaches:

- House Joint Resolution 201 would eliminate all non-school property taxes for homestead properties immediately, taking full effect January 1, 2027.

- House Joint Resolution 203 proposes gradual elimination over 10 years by increasing the homestead exemption by $100,000 annually until non-school taxes disappear entirely.

- Amendment 5, approved by voters in 2024, indexes homestead exemptions to inflation, providing modest but automatic relief as property values rise.

The proposals share two critical provisions: protecting public school budgets and law enforcement funding, but this still leaves other municipal functions facing pressure.

Critics, including Governor Ron DeSantis, worry that putting multiple competing proposals on the ballot would confuse voters and ensure none achieves the required supermajority for constitutional amendments. According to a September 2025 poll, 72% of registered Florida voters support some form of property tax reform, whether through total elimination or limitations, underscoring broad public support for change.

The Florida case reveals the complexity of property tax reform. Simply eliminating property taxes without addressing municipal revenue needs creates new problems. Comprehensive reform is required to protect property rights while maintaining essential services.

The Lock-in Effect and Push-out Effect: Two Sides of Tax Distortion

Property taxes create unique distortions harmful to both entry and exit from housing markets. These effects work simultaneously to reduce market efficiency and harm buyers and homeowners.

- The "Lock-in Effect" discourages families from moving, as new purchases trigger higher property tax assessments. California's Proposition 13, which caps increases for existing owners but reassesses at sale, demonstrates this phenomenon. Similar properties can have substantially different assessed values solely based on purchase dates.

- The "Push-out Effect" forces seniors and low-income residents from homes they've paid off through escalating tax bills unrelated to income.

These dual distortions reduce housing market efficiency. The lock-in effect results in families staying in homes that no longer fit their needs. The push-out effect forces vulnerable homeowners to sell for reasons unrelated to their desires.

Market Solutions That Benefit All Generations

Rather than coercive redistribution, market-based solutions create broadly shared prosperity while respecting property rights:

Land Value Taxation (LVT): Taxes the unimproved value of land, encouraging development without penalizing property owners. By taxing location value, not improvements, LVT incentivizes efficient land use and housing supply increases.

Zoning Reform: Restrictive zoning limits supply and drives up prices. Eliminating barriers, especially for multifamily and accessory units, would create housing abundance benefiting younger buyers.

Mortgage Innovation: Reverse mortgages and other equity-release products allow seniors to access wealth without forced sales, providing liquidity while maintaining ownership.

Intergenerational Housing Models: Multi-generational homes and accessory dwelling units allow families to maximize housing utility through voluntary cooperation.

The Moral Imperative of Property Rights

Property rights represent a moral imperative. The right to own property free from arbitrary seizure is foundational to liberty and dignity. Arguments to force downsizing invert moral reasoning, subordinating individual rights to collective calculations that disadvantage vulnerable groups.

The proper moral frame asks: How do we create abundance that benefits everyone while respecting individual rights? Coercive redistribution creates conflict and undermines social cohesion, while strong property rights and markets drive prosperity.

Why Younger Generations Need Strong Property Rights

Secure property rights benefit younger generations by enabling parents to accumulate and transfer wealth, helping children with down payments and intergenerational stability. Secure ownership encourages investment and broad economic growth, benefiting new labor market entrants.

Regulatory distortions impede housing solutions; market freedom enables voluntary innovation, reducing housing costs more than forced redistribution ever could. Treating housing as a collective resource to be redistributed undermines everyone’s security.

Conclusion: The Path to Housing Abundance

The solution to generational housing tension is not coercion—it is abundance through property rights, market freedom, and regulatory reform. By protecting ownership, removing zoning barriers, and respecting voluntary exchange, we secure the American dream for all generations. Forced downsizing and age-based taxation only create zero-sum conflict—true prosperity comes from the principles that built America's housing security.